Music hi and welcome to today's video where we're talking about IRS Form 88 21 tax information authorization. This form allows any individual organization or tax professional to receive confidential tax documents for their client. It can also revoke previous tax information authorizations that are no longer required. You can identify what returns your client needs to file how much tax interest and penalties are due or if their account is in collections, but there are several actions that form 8820 one does not authorize you to do. The biggest misconception with this form is that it authorizes representative power. Form 8820 one cannot authorize you to represent your clients before the IRS this includes speaking to the IRS on your client's behalf executing waivers consents closing agreements or any other representative matters. You need to fill out form 2848 power of attorney and declaration of representative. Go check out our video on form 2848 to learn more about it. Tip number 2 is to play it safe. You're probably wondering why would I bother with the form 88 21 if you can just fill out form 28 48. Here's life in many cases clients don't tell you the full story right away. This can make it difficult to decide if you want to take a client on. In these instances, you want to start with a form 88 21. The ad 821 allows you to assess your clients tax situation before becoming more liable yourself once you file form 2848. You are expected to represent your client if you do not meet the expectation of a rigorous defense on behalf of your client. You may be subject to a professional liability lawsuit or malpractice if you fill in form 88 21 first. Furthermore, you can get access to all the information...

PDF editing your way

Complete or edit your form 8829 for 2021 anytime and from any device using our web, desktop, and mobile apps. Create custom documents by adding smart fillable fields.

Native cloud integration

Work smarter and export 2021 form 8829 instructions directly to your preferred cloud. Get everything you need to store, synchronize and share safely with the recipients.

All-in-one PDF converter

Convert and save your form 8829 instructions 2021 as PDF (.pdf), presentation (.pptx), image (.jpeg), spreadsheet (.xlsx) or document (.docx). Transform it to the fillable template for one-click reusing.

Faster real-time collaboration

Invite your teammates to work with you in a single secure workspace. Manage complex workflows and remove blockers to collaborate more efficiently.

Well-organized document storage

Generate as many documents and template folders as you need. Add custom tags to your files and records for faster organization and easier access.

Strengthen security and compliance

Add an extra layer of protection to your instructions form 8829 pdf by requiring a signer to enter a password or authenticate their identity via text messages or phone calls.

Company logo & branding

Brand your communication and make your emails recognizable by adding your company’s logo. Generate error-free forms that create a more professional feel for your business.

Multiple export options

Share your files securely by selecting the method of your choice: send by email, SMS, fax, USPS, or create a link to a fillable form. Set up notifications and reminders.

Customizable eSignature workflows

Build and scale eSignature workflows with clicks, not code. Benefit from intuitive experience with role-based signing orders, built-in payments, and detailed audit trail.

Award-winning PDF software

How to prepare Form Instructions 8829

About Form Instructions 8829

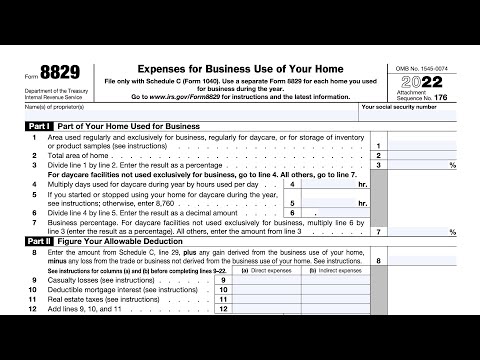

Form Instructions 8829 is a document provided by the Internal Revenue Service (IRS) that provides guidance on how to complete Form 8829, also known as the "Expenses for Business Use of Your Home." This form is designed for individuals or sole proprietors who use a part of their home exclusively for business purposes. It allows them to deduct certain expenses related to the business use of their home, such as mortgage interest, property taxes, rent, utilities, repairs, and depreciation. The Form Instructions 8829 provide detailed explanations on how to calculate and claim these deductions accurately. It outlines the eligibility criteria for claiming the home office deduction and offers guidance on how to allocate and calculate expenses, providing examples and illustrations. It is essential for taxpayers who meet the requirements for claiming the home office deduction to carefully review and follow the instructions in Form Instructions 8829 to ensure compliance with IRS regulations and maximize their deductions while accurately reporting their business expenses.

What Is 2025 irs instructions form printable?

Online technologies allow you to arrange your document administration and increase the efficiency of the workflow. Observe the short guideline in an effort to complete 2025 Form Instructions 8829 printable. Stay away from errors and furnish it in a timely way:

How to fill out a form 8829 instructions 2019?

-

On the website containing the document, press Start Now and pass towards the editor.

-

Use the clues to fill out the pertinent fields.

-

Include your individual details and contact information.

-

Make sure you enter correct data and numbers in appropriate fields.

-

Carefully review the data in the form so as grammar and spelling.

-

Refer to Help section when you have any issues or contact our Support team.

-

Put an electronic signature on your Form Instructions 8829 printable while using the help of Sign Tool.

-

Once the form is finished, click Done.

-

Distribute the ready blank by way of electronic mail or fax, print it out or save on your gadget.

PDF editor makes it possible for you to make modifications to your 2025 Form Instructions 8829. Fill Online from any internet linked gadget, customize it according to your requirements, sign it electronically and distribute in different approaches.

What people say about us

The best way to submit templates without having mistakes

Video instructions and help with filling out and completing Form Instructions 8829